AU Small Finance Bank

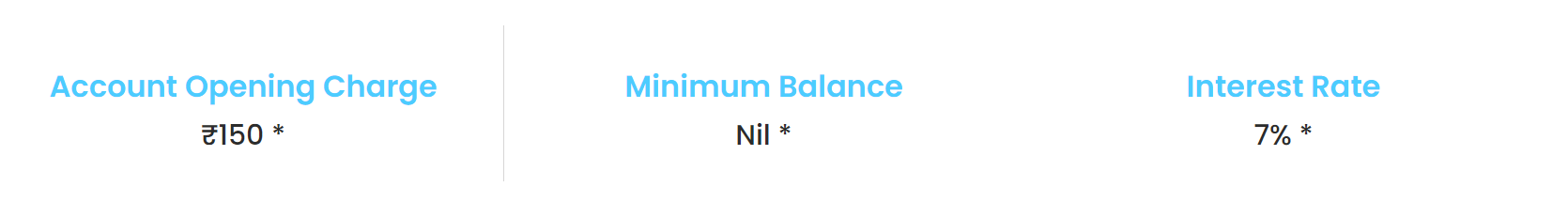

Get Up to 7.25*% per month on AU Small Finance Bank

Eligibility

- For Citizens: Any person who is a citizen of the country and is at least eighteen years old can open an account, either alone or with someone else.

- For Residents: People who live in the country and are at least eighteen years old can open an account, either alone or with someone else.

- For Foreign Nationals and HUF: Even if you're not a citizen or belong to a Hindu Undivided Family, you can still open an account if you're at least eighteen years old.

Documents Required

- ID Proof:- Driving License, Passport, Voter's ID, Aadhaar Card

- Address Proof:- Passport, Driving License, Voter's ID, Aadhaar Cards, Utility Bill, Financial institution Statement

- Signature Proof:- PAN Cards, Driving License, Passport

- Latest Passport Size Photographs

Why Saving Account?

- Easy to Open: AU digital savings accounts are quick, paperless, and secure when you open them online.

- Access to Services: With this account, you can enjoy various banking services like instant transfers, phone banking, and SMS banking.

- Earn Interest: It's beneficial to have a bank that pays you interest on the money you save. AU Bank offers one of the highest interest rates among banks, although rates can change over time.

How to apply

Step 1: Start by choosing a bank that meets your requirements and preferences.

Step 2: Next, select the type of account that best suits your needs and financial goals.

Step 3: Collect essential KYC documents such as your PAN card, Aadhar card, and a recent photograph.

Step 4: Get ready for a video KYC process by ensuring you have a pen and paper handy for note-taking during the verification.

Step 5: Once you're ready, add funds to your account using a debit card or through net banking.